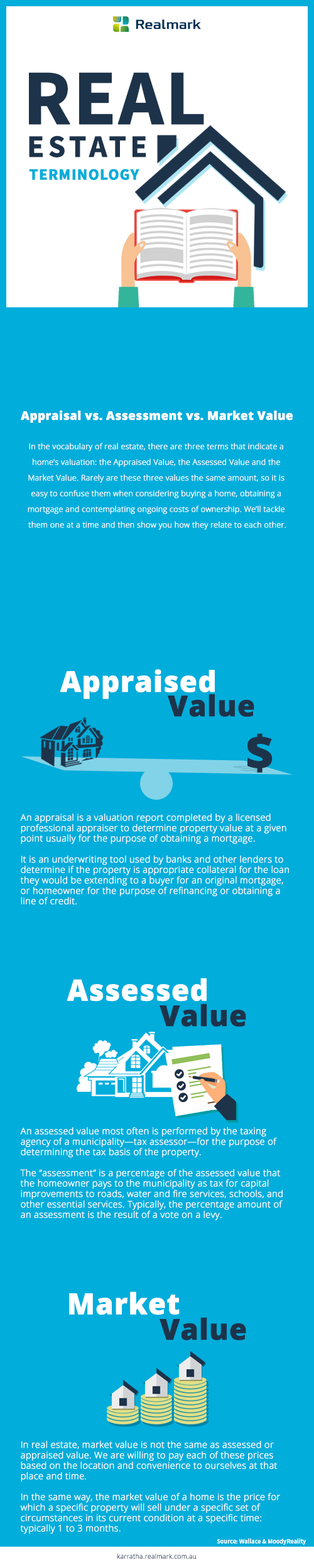

It is easy to confuse them especially when buying your first property, getting that mortgage and figuring out the cost of ownership can be a burden on top of that. So it is only right to know the differences as it is seldom that these three values end up with the same amount.

Appraised Value

“An appraised value is an evaluation of a property's value based on a given point in time that is performed by a professional appraiser during the mortgage origination process. The appraiser is usually chosen by the lender, but the appraisal is paid for by the borrower.” – Investopedia

In addition to that, the results are used by banks and other lenders to determine if the property is sufficient collateral for the loan they would be extending to a buyer for an original mortgage, or homeowner for the purpose of refinancing or obtaining a line of credit.

To determine the value, the appraiser uses recently sold similar properties in the evaluation. While taking into consideration the differences in amenities, square footage, building materials used and other factors used to set as a basis for the appraisal.

This enables the appraiser to provide valuation using specific methods like the cost to rebuild the property (similar basis to homeowner insurance) and if it has potential to earn then from rental income.

These numbers are not fixed and there is no standard benchmark from which the appraisers use as reference. It is frequently based on the experience and knowledge of the area and the property type.

As for people looking to buy a property, an appraisal that the mortgage lender uses is important because it determines the amount of money then can borrow for their home loan. This is also essential for current owners as it gives them an idea of how much they can sell their property or the amount they can get should they consider a second mortgage.

Assessed Value

“An assessed value is the dollar value assigned to a property to measure applicable taxes. Assessed valuation determines the value of a residence for tax purposes and takes comparable home sales and inspections into consideration. It is the price placed on a home by the corresponding government municipality to calculate property taxes. In general, the assessed value tends to be lower than the appraisal fair market value of property.” - Investopedia

One striking difference is that unlike appraised value which is based on a private assessor’s discretion, in determining the assessed value; it covers for not only the property but the entire neighborhood, city or even country during the evaluation.

Thus, the assessment is then a corresponding number value to which the currency may fluctuate as the city / province has need of more or less income. It is important to note that while tax rates varies annually, assessed value only changes when the values become outdated caused by changing overall structure in the city such as increase in emergency services, traffic lights, fire, etc. This varies from one city to another, states and vice versa.

Market Value

Lastly, market value is not the same as assessed or appraised value in a way that it is determined by totally different set of factors. Influences such as convenience, demand, and location at a specific date or time often determine the price one is willing to pay for a property. In addition, the market value land is the price under which this certain property will sell under a specific set of circumstance in its most recent condition at a specific time.

It is often difficult to determine exact market value especially that circumstance plays often influence the price. Home owner’s status my change so as the property’s condition, the light as the buyer’s circumstance or the community itself in general. That is why often, the market value of a property is determined by the amount it will sell for within a month to 3 month period. Properties sold earlier may not reflect the market value as well.

Outcomes

Although there may be times that the total amount may be similar or the same at some point, it may not be accurate if the local districts fails to update their assessments timely. This may also apply to the appraisals done by appraiser as they need to justify to the lender perceived value of specific communities or development.

In some cases, a keen buyer might be willing to pay premium to secure a property faster thus influencing its actual market value.